For FedEx contractors, Individual Vehicle Mileage Reports (IVMR) are not just standard; they are essential for ensuring compliance and accuracy when filing IFTA. But even if you’re not a FedEx contractor, having IVMRs can significantly simplify the process of filing IFTA. These detailed reports summarize the movement of each vehicle within a fleet, providing crucial data on everything from state crossings to driver details. Not only are they indispensable for calculating accurate IFTA filings, but they also provide invaluable insights that can help optimize your lanes and ensure you pass any potential audits with ease.

What’s Inside an IVMR?

An IVMR is packed with important data that tracks the movement of each vehicle, including:

- State boundaries crossed

- Arrival and departure times from various locations

- Specific details about each driver involved

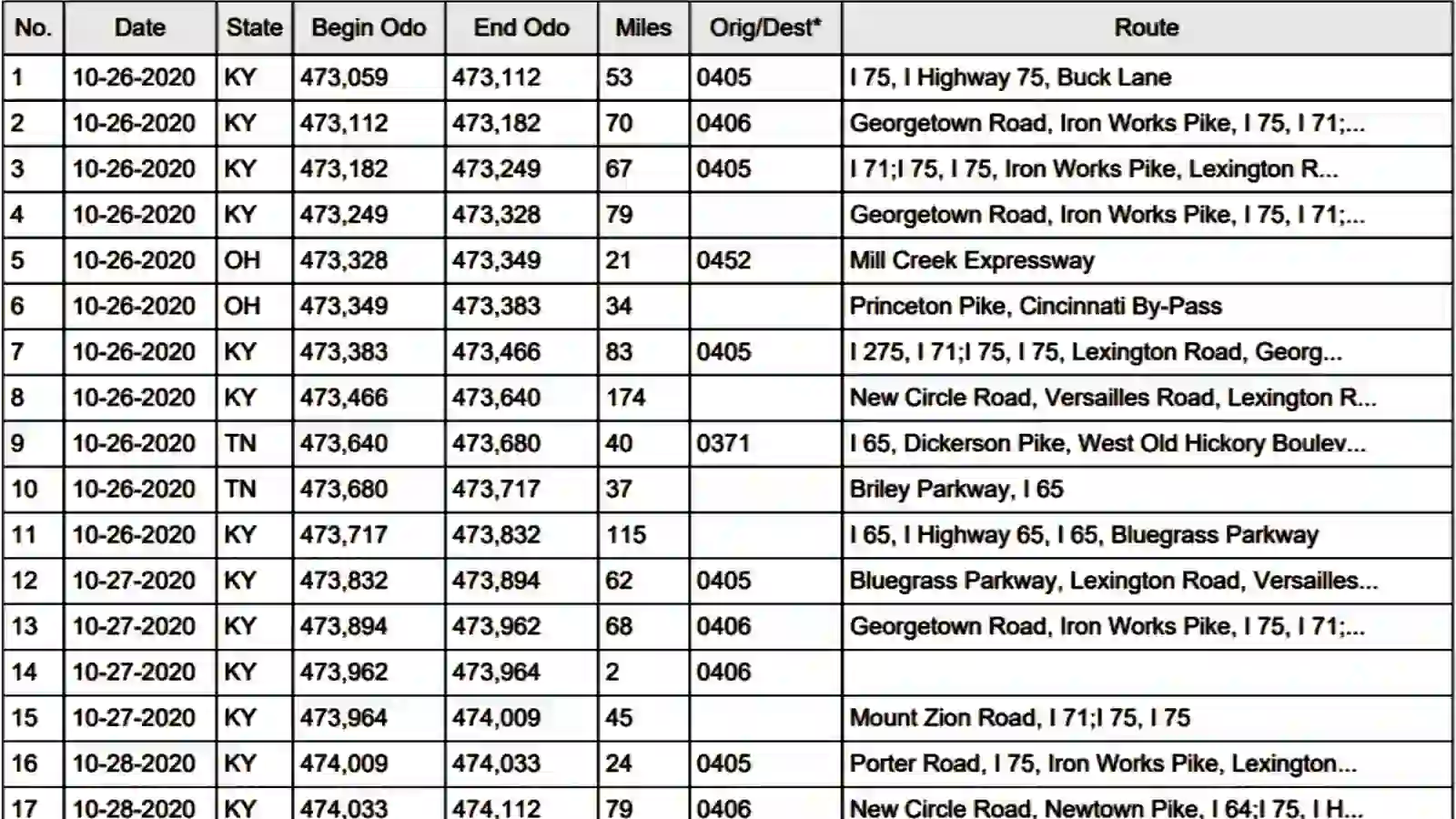

IVMRs serve as the foundation for calculating IFTA reports, ensuring accuracy in tax filings based on fuel usage in different states. Let’s dive into an example IVMR to see how it works in action:

How To Read an IVMR

From row Number 1, on 10/26, this particular vehicle started the day with an odometer reading of 473,059 and traveled 53 miles along Interstate Highway 75 and then entered a location named ‘0405’. The vehicle then departed from 0405 and traveled 70 miles to 0406, then 67 miles back to 0405. After leaving 0405 for the second time, the vehicle traveled 79 miles and entered the state OH, then another 21 miles and entered a location named 0452.

This kind of detailed reporting helps you trace every movement of the vehicle for precise mileage tracking.

How To Create an IVMR

There are three triggers for creating a new line:

- Time in the domicile timezone crosses midnight

- The vehicle enters an origin or destination location

- The vehicle crosses a state boundary

Traditionally, the IVMR was recorded by hand by the driver as he completed his trips. Look at Row 10, the driver crossed a state line from Tennessee to Kentucky. As the driver is driving down the road, they had to make a mental note of the exact mileage when they crossed the invisible line demarcating the separate states. Then, 115 miles later, the driver had to make another mental note of the precise mileage when the clock struck midnight, and they had to begin row 12. The driver can not safely fill in the report while driving, so they must remember those mileage numbers until they stop the vehicle.

Now that Electronic Logging Devices (ELD’s) are required, reports can be created from the GPS and Electronic Control Module data generated by the ELD device. The automated creation of the IVMR is far more accurate.

Using IVMRs For Better Efficiency and Compliance

IVMRs are the backbone of many essential trucking reports, such as the quarterly state mileage breakdown used for IFTA filings. Before the digital era, administrative staff had to manually sort through handwritten IVMRs, tallying up miles driven in each state, which was not only time-consuming but also error-prone. These miscalculations often led to disputes and audits.

Thanks to GPS-enabled ELDs, you can now instantly generate accurate mileage reports for every vehicle in your fleet, saving hours of administrative work and reducing the likelihood of costly mistakes.

The Role of IVMRs in Audits and Compliance

State agencies often request IVMRs during audits, and maintaining accurate records is crucial for passing IFTA and DOT inspections. Most states require IVMR data to be stored for at least five years. With automated IVMRs, you can quickly generate tailored reports based on specific audit criteria and timeframes. No more digging through old files or copying handwritten logs—everything you need is just a few clicks away.

By using IVMRs correctly, trucking companies can ensure compliance, protect themselves from audits, and maintain accountability across their fleet.

Conclusion

IVMRs are more than just a requirement for IFTA—they are a powerful tool that helps trucking companies stay compliant, save time, and reduce errors. By moving from manual logs to GPS-enabled, automated systems, you can streamline your operations, pass audits effortlessly, and ensure the accuracy of your filings. Whether you’re a FedEx contractor or a fleet operator, understanding and utilizing IVMRs is crucial for maintaining operational efficiency and regulatory compliance.