The American Association of Motor Vehicle Administrators (AAMVA) developed the International Registration Plan (IRP) to streamline interstate trucking operations and enhance commerce. The IRP allows for a single commercial vehicle registration that is valid across all participating states and provinces, making it easier for carriers to operate across borders.

The IRP is a reciprocity agreement between U.S. states, the District of Columbia, and Canada. It allows commercial vehicles to register in one jurisdiction while paying fees based on the percentage of miles traveled in each participating state or province. Vehicles over 26,000 pounds that operate in multiple jurisdictions must be registered under IRP.

Under IRP, there are two primary types of license plates for commercial trucks: Base Plates and Apportioned Plates (IRP plates). Let’s break down the differences:

Base Plates vs. Apportioned Plates

If your truck never travels outside of the state, a Base Plate will suffice. When registering for Base Plates, you can choose which states you wish to operate in and pay accordingly. The cost of these plates depends on the number of states you sign up for and the mileage driven in each state. In some cases, it may even be more cost-effective to register with a state you frequently travel through, even if your company is based elsewhere.

However, if you plan to operate across state lines, the process becomes more complex. In this case, you’ll need to register under the International Registration Plan, also known as Apportioned Registration. With IRP, you’ll receive an Apportioned License Plate and an Apportioned Cab Card. The cab card lists the states and provinces where your vehicle is registered to operate.

The Benefits of IRP Registration

The main benefit of IRP is that a tractor or carrier only needs one license plate (marked as "Apportioned," "APP," or "ARP") in their base jurisdiction. The corresponding cab card specifies the states the vehicle can travel to, as well as its permitted weight limit. This simplifies the registration process, as it ensures that all jurisdictions receive their fair share of registration fees based on the percentage of miles driven in each area.

How is IRP Registration Calculated?

The cost of IRP registration depends on several factors, including the base state, the vehicle's gross vehicle weight (GVW), and the jurisdictions where the vehicle is registered. To calculate the IRP fees, you’ll need to know the percentage of miles driven in each state and the applicable fees for each jurisdiction.

For example, for a truck with a GVWR of 80,000 pounds traveling in all 48 contiguous states, the cost typically ranges between $1,500 and $2,000. However, this can vary depending on your base state and the specific jurisdictions you register in.

Key factors that determine the registration fees include:

- Percentage of miles driven in each jurisdiction

- Vehicle identification information

- Maximum Gross Vehicle Weight (GVWR)

- Vehicle value

- Vehicle age

- Unladen weight

To determine the apportioned fee for each state, calculate the distance driven in that state, divide by the total miles traveled, and multiply by the state's registration fee. Add up the fees from all states to get the total IRP registration cost. Your base state will provide a form to fill out to obtain your apportioned plates.

Tracking Miles for IRP: How to Do It Right

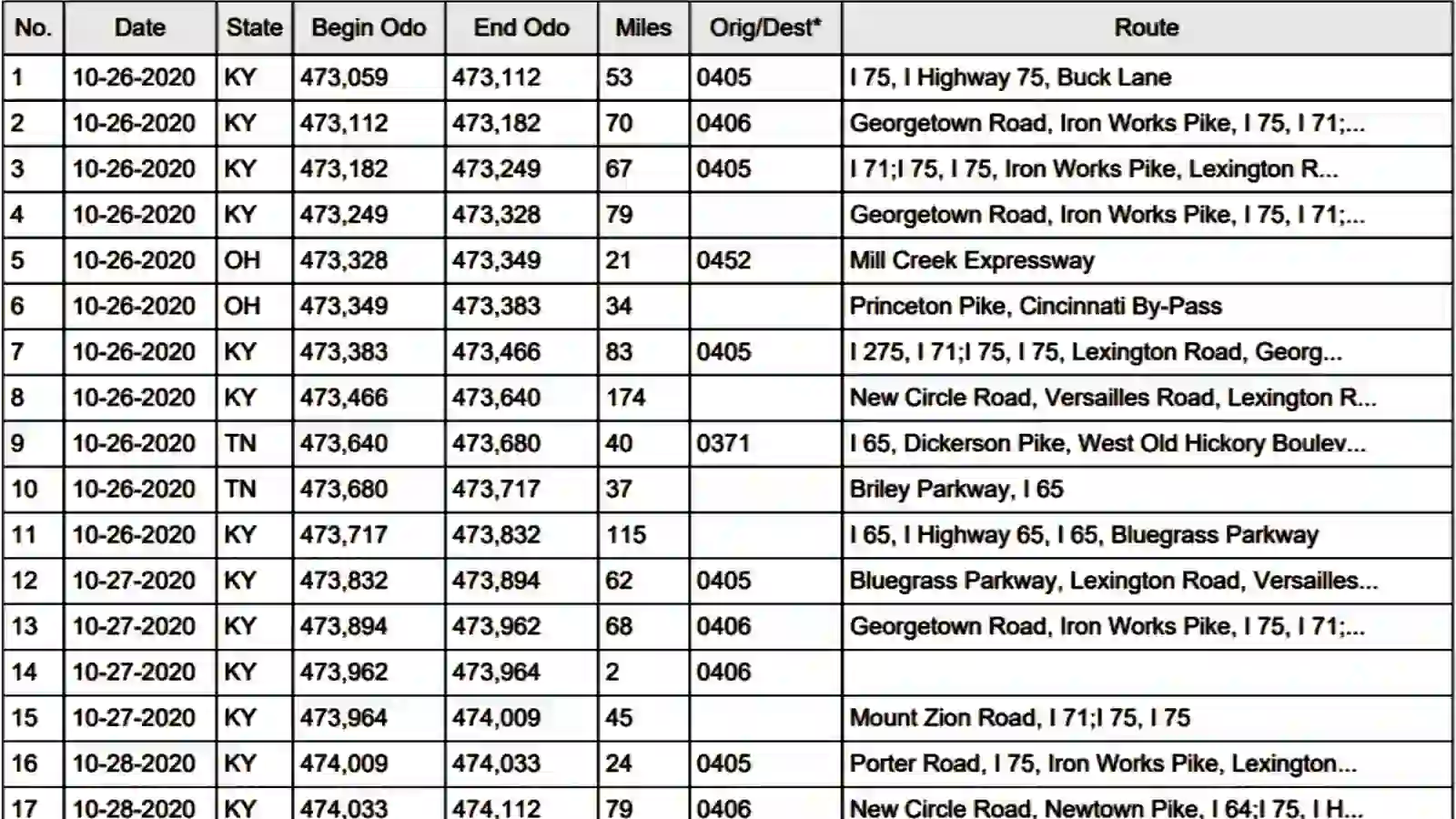

Much like IFTA, IRP requires accurate tracking of the miles your fleet drives in each state. You can track miles manually by having drivers log their state mileage, but this method is prone to errors and time-consuming. I highly recommend using software to track these miles accurately. Your ELD or GPS tracking system should be able to generate a state-specific mileage report to ensure precise data collection.

Pro Tip: If you need software that can accurately calculate state miles and provide a robust audit trail, we can help. Our solution is designed to make your life easier and keep your records in top shape for audits.