The International Fuel Tax Agreement (IFTA) is a collaborative agreement among U.S. states and Canadian provinces that governs fuel tax obligations for commercial motor vehicles. This agreement allows vehicles to register in one state and pay taxes to all participating areas based on their share of fuel consumption.

IFTA was designed to simplify accounting for truckers who frequently travel across state lines, easing the burden of tax documentation and ensuring the correct allocation of fuel taxes.

How Does IFTA Work?

Imagine this scenario: A large truck has 200-gallon fuel tanks with a range of about 1,200 miles. The truck fills up in Texas and takes a round trip to Kansas City, traveling through Texas, Oklahoma, and Kansas, and then back. When the truck buys fuel in Texas, it pays the state excise tax on the fuel, meaning Texas receives the tax revenue. However, as the truck drives through other states, Oklahoma and Kansas don't receive any excise tax revenue, even though they maintain their roads. Enter IFTA—ensuring each state gets its fair share of fuel tax revenue.

Through IFTA, when a truck or fleet is registered, it receives a fuel tax permit from one state. As the truck purchases fuel, the tax is credited to the permit holder's account. At the end of each quarter, a fuel tax report is generated that reflects the miles driven and gallons of fuel purchased in each jurisdiction.

IFTA calculates the amount of tax due or the credit owed for each state, ensuring that funds are properly distributed. The quarterly IFTA report helps carriers determine the tax owed or if a refund is due by comparing the fuel purchased with the mileage driven in each state.

How to Calculate Your IFTA?

To get started, gather the following data:

- Fuel receipts for the reporting period

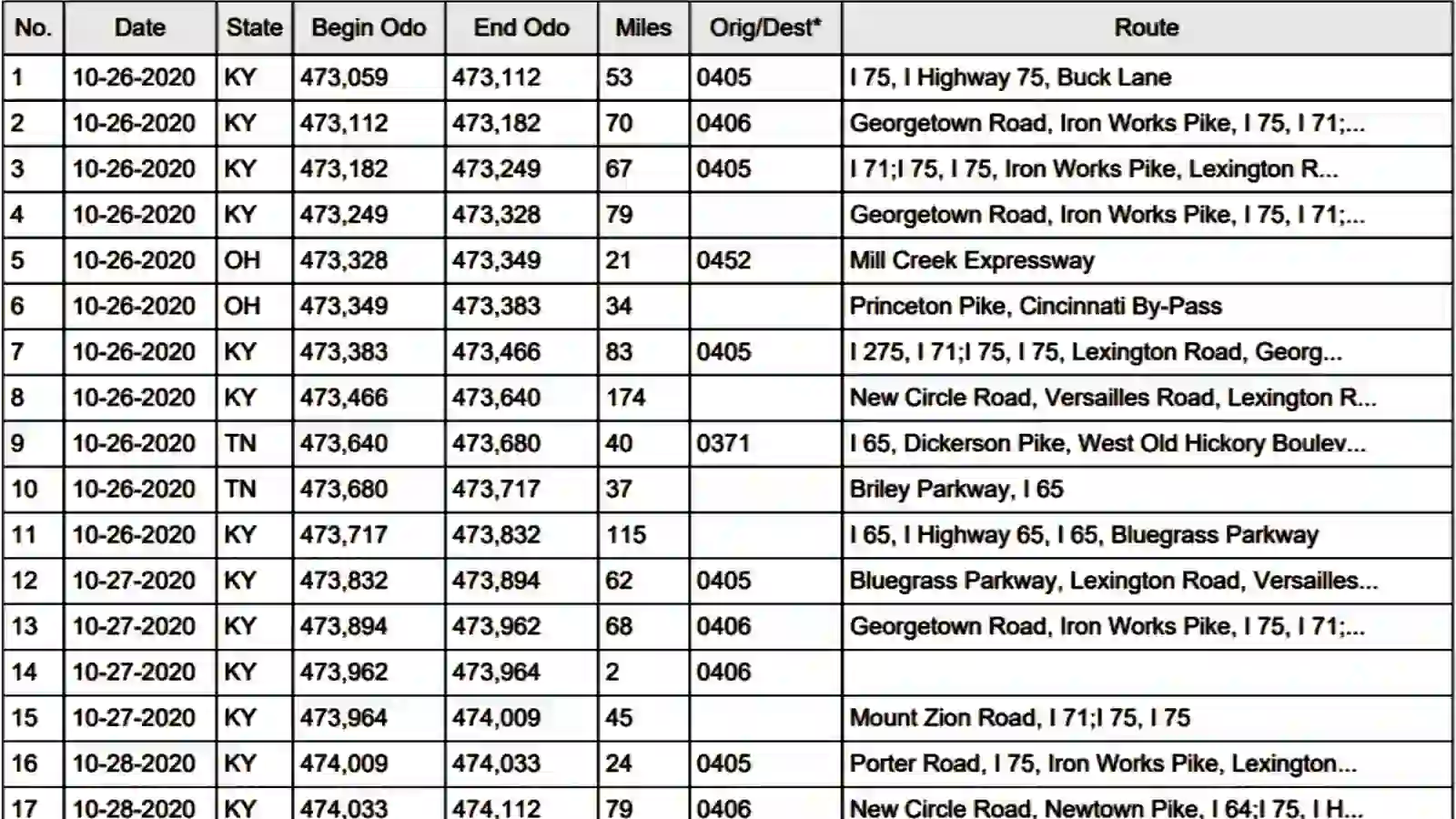

- Record of miles traveled in each jurisdiction

- Fuel tax rates for the quarter from each jurisdiction

Step 1: Gathering Your Fuel Receipts

If you're using a fleet fuel card, this step should be straightforward, as you can easily generate a report showing gallons purchased by state.

If not, you'll need to rely on your drivers' fuel receipts, which can lead to significant data entry work.

Pro Tip: If you don’t have a fleet fuel card, we offer an excellent program that tracks state gallons automatically, with built-in fuel discounts. Reach out to us for more information!

Step 2: Calculating Your State Miles

If you have an ELD or GPS tracking system, you can generate this data from the reports. However, keep in mind that these systems can sometimes make errors, such as missing or incorrect mileage data.

Pro Tip: We specialize in accurate state mileage tracking for fleets, including FedEx. Contact us if you need help with this step!

If you don't have GPS or ELD systems, you'll need to rely on manual trip sheets from your drivers. Best of luck with this method, as it's prone to mistakes and can be time-consuming.

Step 3: Gather Tax Rates

This is the easy part. You can find the tax rates online or in your state’s IFTA addendum.

Now, Time to Do Some Math...

We recommend using an Excel sheet to calculate your IFTA. Here's an example of how your data should be structured:

| State | Total Miles | Purchased Gallons | Taxable Gallons | Net Taxable Gallons | Tax Rate | Tax Owed/Refunded |

|---|

You can download my IFTA template here.

Once your table is populated, calculate the total fuel economy by dividing the total miles traveled by the total gallons purchased in each state:

Fuel Economy = Total Miles / Total Gallons Purchased

Then, calculate the taxable gallons by dividing the miles driven in each state by your fleet's average fuel economy:

Taxable Gallons = Miles in State / Fuel Economy

Next, determine the net taxable gallons by subtracting the purchased gallons from the taxable gallons:

Net Taxable Gallons = Taxable Gallons - Purchased Gallons

Finally, calculate the tax owed or refunded using the formula:

Tax Owed or Refunded = (Net Taxable Gallons * Tax Rate) - (Purchased Gallons * Tax Rate)

This will give you a positive number if tax is owed or a negative number if a refund is due. Add up the tax owed/refunded column to determine the total amount.

Validating Your Data

It's crucial to ensure your data is accurate. Here are a few validation tips:

- Sanity check your fuel economy: If your fleet’s fuel economy seems unusually high or low, it could indicate errors in your data.

- Perform a fuel economy analysis on each truck: Identify any vehicles with unusually high or low fuel economy, which may indicate data discrepancies.

- Run a fuel exception analysis: Check for instances where fuel was purchased in a state where the truck wasn’t physically present. This can flag potential data issues.

Filing Your Return

Most states require you to file your IFTA return electronically. Double-check for typos and review any state-specific rules. For example, in Pennsylvania, if your fleet fuel economy exceeds 6.41 mpg, you must use 6.41 mpg for the calculation.

Pro Tip for Pennsylvania residents: If your fleet averages over 6.41 mpg, consider obtaining an IFTA license in another state.

IFTA Audits

IFTA audits can be a nightmare, especially if your records aren't organized. Keep all your documents for at least five years, as required by IFTA. During an audit, the auditor will sample your data and dig deeper if they find discrepancies.

Pro Tip: Using software to track IFTA is a low-cost investment compared to the expense and stress of an audit. Trust me, it’s worth it!