At this year’s Linehaul Summit, Flint Holbrook (founder and CEO of TruckSpy) spoke on a topic relevant to all FedEx contractors operating in 2023: the state of FedEx Linehaul today. He took a survey to gather data on contractor performance in 2022-2023 and analyzed the results and what they might mean for the future.

How Are We Doing?

FedEx Ground is incredibly important to overall FedEx revenue, but with recent changes made by FedEx and in the economy in general, it’s interesting to see how contractors have been doing over the past year.

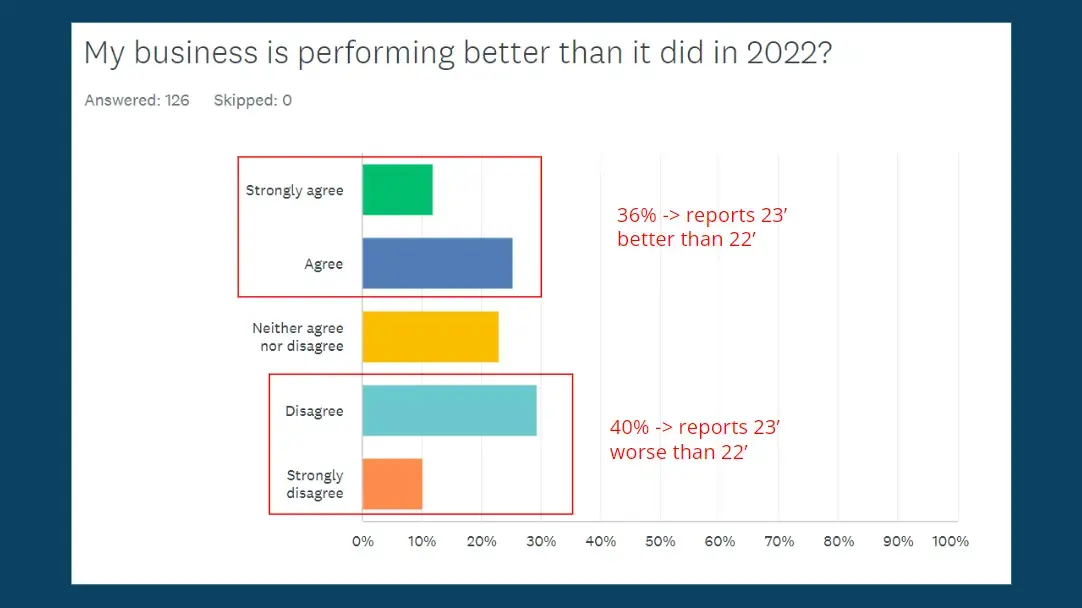

Interestingly, when the contractors polled were asked if their businesses did better or worse this past year, the answer was split right down the middle.

Some expected that bigger contractors would slowly begin to take over, especially since it’s easier to give new routes to more established carriers. Apparently the trend is the opposite, with bigger contractors becoming a ‘smaller piece of the pie.’ Contrary to what many might think, the data suggests that new, smaller carriers are welcome in the industry.

Cost Pressures

It’s no secret that most FedEx contractors–big and small–have to deal with significant cost pressures. Hiring, turnover and balancing company expenses are always huge concerns.

Based on our survey we found that the number of understaffed companies is significantly lower than expected. Contractors also reported that drivers have been easier to hire over the past year, while turnover stayed the same. At the same time, most also reported that their labor costs have increased. What’s the reason for this interesting trend?

It may be that while drivers in general are becoming more transient, quality drivers are sticking around. Carriers are finding that they still need to raise pay in order to be competitive in this economy.

Dwell Times

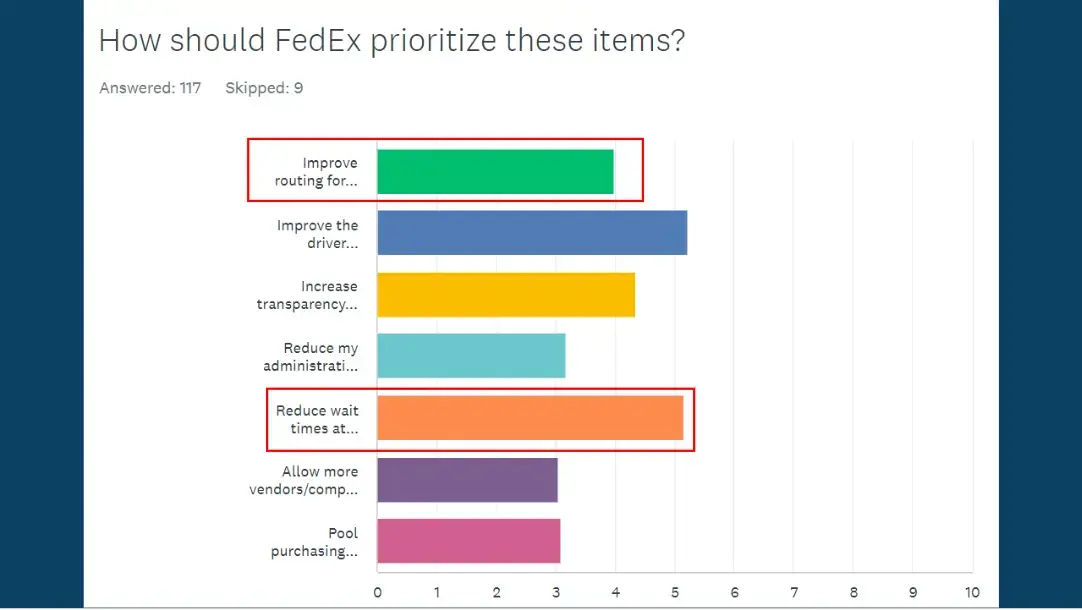

When asked what issues they thought FedEx should address, many carriers would choose to improve routing and reduce dwell times.

Dwell times can affect a company’s whole operation, which is why long dwell times can be so problematic. The median dwell time is actually only 37 minutes, but there are outliers to this figure and certain terminals experience significantly longer dwell times. Flint’s advice to carriers affected by this? Contractors experiencing high dwell times should build a data set and share their findings with terminal managers. This will make FedEx aware of the issue and know what can be done to fix it.

What’s it Like to Be a FedEx Contractor?

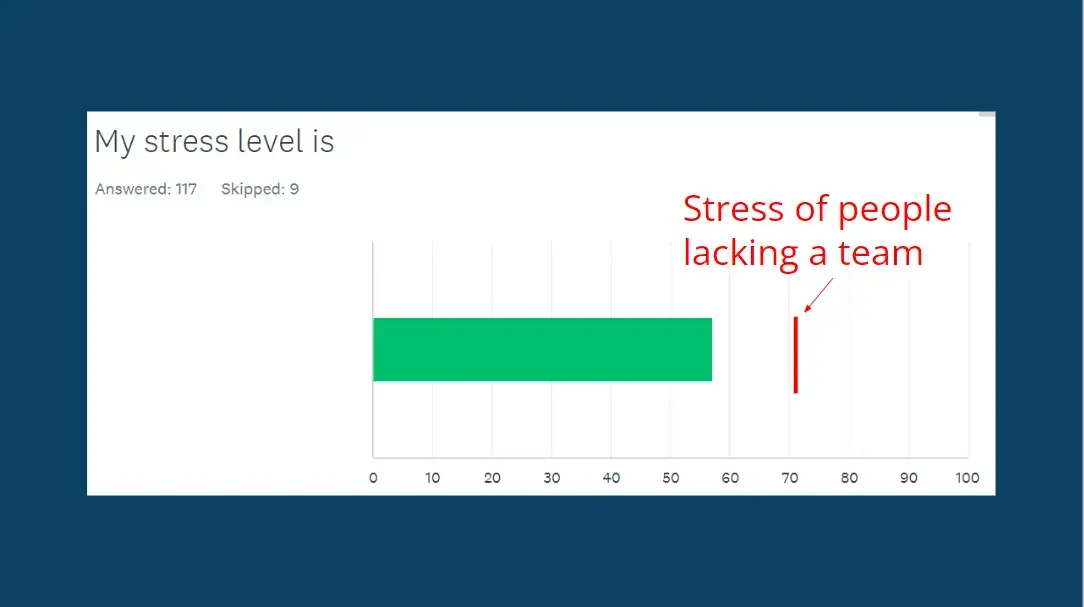

While most contractors reported experiencing a moderate level of stress, the stress level of those operating without a team was significantly greater.

This highlights the importance of having a team to support your business and assist with operations, especially in an administrative capacity.

Interestingly, we found that many contractors reported having at least some time to do the things they enjoy, and most find fulfillment in their work despite the stress. Most also feel that over the next year their business will perform the same or better than it has in the past.

The Future of FedEx Linehaul

Earlier this year FedEx announced an initiative that will eventually merge their separate delivery units into one, a program called DRIVE. It’s interesting to note that since that announcement, both FedEx Freight and Express have been cut back– but not Linehaul.

Based on observations and statistics over the past year, Flint predicts that FedEx Freight and Express will end their current tractor/trailer operations, leaving Linehaul to absorb all volume. If this prediction is correct, it would mean good things for the Linehaul industry over the next year.

Check out the full video on YouTube and let us know what you think!