IVMRs are essential for FedEx contractors. These reports provide detailed summaries of vehicle movements, including crossing state borders, origin and destination locations, and driver information. IVMRs are the foundation for precise IFTA reporting and can aid in lane analysis, as well as easily passing IFTA or IRP audits. An IVMR allows you to record and monitor a wide variety of vehicle performance and driver data, which can help you make more informed decisions about your operations, while also providing you with IFTA reporting capabilities.

Reading an IVMR

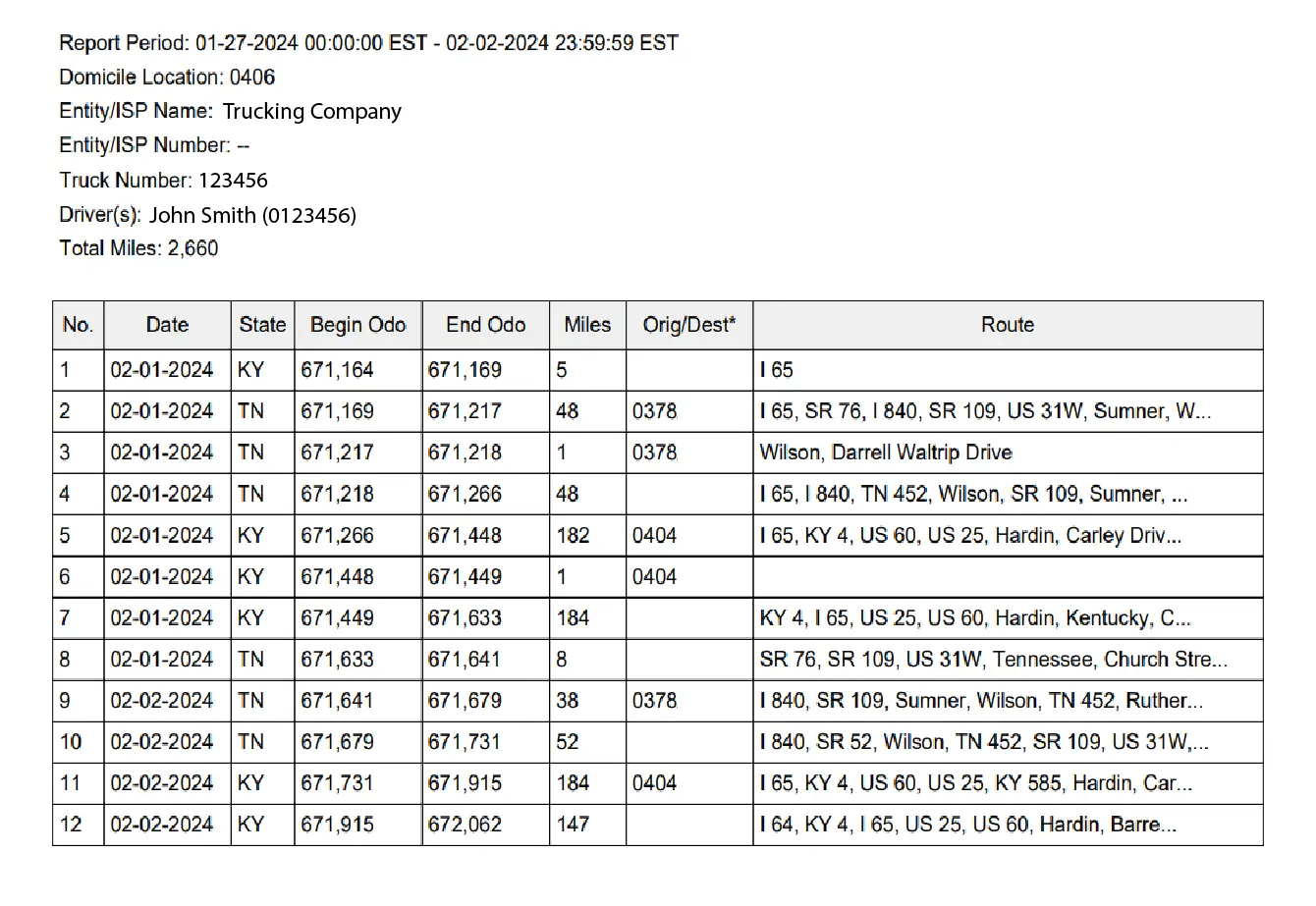

Take a look at an example IVMR report:

Starting from row 1 on 2/1, this vehicle began its journey with an odometer reading of 671,164. It covered 5 miles along Interstate 65 before crossing into Tennessee. It then traveled another 48 miles before arriving at a location called ‘0378’. (These origin and destination points are also referred to as terminals or domiciles.) The vehicle then traveled 1 mile before parking at 0378 again. Later, the vehicle left 0378 and covered 48 miles to enter the state of Kentucky. It traveled an additional 182 miles to reach terminal 0404.

How it Works

The process of creating an Individual Vehicle Mileage Record (IVMR) is a crucial step for any Fedex contractor. Traditionally, the IVMR is recorded by hand by the driver as they complete their trips. It involves documenting key information about each trip, including the starting and ending locations, the total mileage, and any fuel purchases made along the way. The IVMR serves as the basis for other mileage reports, such as quarterly state miles used to file International Fuel Tax Agreement (IFTA) reports.

To create an IVMR, the driver must accurately record all relevant details for each trip. This typically includes the date and location of departure, as well as the destination and the route taken. Additionally, the driver must document the starting and ending mileage for each trip.

Once the IVMR is complete, this record is retained for IFTA filing and compliance purposes. Most states require trucking companies to retain IVMRs for a minimum of five years to satisfy IFTA and Department of Transportation (DOT) audits. These records are often used to verify the accuracy of mileage reports and ensure compliance with tax regulations.

By meticulously recording and maintaining IVMRs, trucking contractors ensure accurate mileage reporting. The data captured in these records can also provide valuable insights for analysis, such as lane analysis and operational decision-making.

Overall, understanding how the IVMR works is essential for FedEx contractors in today's trucking industry. It is not only a requirement for IFTA filing but also a tool for monitoring vehicle performance and driver behavior. By effectively managing IVMRs and utilizing them as a basis for mileage reports, contractors can maintain compliance, improve operational efficiency, and confidently navigate IFTA and DOT audits.

The Do-It-All Fleet Management Platform.

Start Today, No Contract. No CC.

Automating Your IVMRs

Traditionally, sorting through handwritten IVMRs and manually calculating the mileage driven in each state for each month is a time-consuming and tedious process. However, with the introduction of Electronic Logging Devices (ELDs), this process has become much simpler and more efficient.

ELDs equipped with GPS technology can quickly and accurately calculate mileage data for every vehicle in your fleet.

One of the key advantages of automating your IVMRs is the ability to generate specific reports based on the audit criteria and timeframe you require. With GPS-enabled ELDs, you can easily access detailed mileage information for each vehicle, allowing you to monitor performance, analyze route efficiency, and make informed operational decisions.

TruckSpy software takes automation one step further by pulling data directly from your ELD provider and generating completely automated reports. This not only saves time and effort but also ensures accuracy and compliance with IFTA and DOT regulations. Our software eliminates the need for manual data entry and minimizes the risk of human error.

By automating your IVMRs, you can streamline your operations, improve efficiency, and gain valuable insights into your fleet's performance. With the help of ELDs and innovative software solutions like TruckSpy, FedEx contractors can simplify their IVMR process and focus on growing their business.